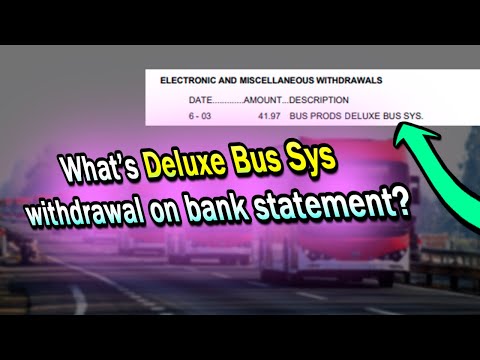

What Is Deluxe Bus SYS On Bank Statement? Explained

This article aims to provide information on What Is Deluxe Bus SYS On Bank Statement? When you scrutinize your bank statement, you might come across various entries that seem cryptic. One such entry is Deluxe Bus SYS. This phrase can be baffling, especially if you don’t recall any related transactions. In this comprehensive guide, we decode what Deluxe Bus SYS stands for and why it appears on your bank statement.

Key Takeaways

- Deluxe Bus SYS is typically linked to transactions related to bus transportation services.

- It could signify a payment made for a deluxe bus service, possibly for travel or commuting purposes.

- Understanding such entries is crucial for accurate financial tracking and fraud prevention.

What Is Deluxe Bus SYS On Bank Statement?

When you see Deluxe Bus SYS on your bank statement, it usually indicates a payment made to a deluxe bus service provider. This could be for a variety of services ranging from long-distance travel to luxury commuter buses. Identifying such transactions is essential for personal financial management.

Importance of Recognizing Bank Statement Entries

Understanding the nature of Deluxe Bus SYS entries on your bank statement is vital for several reasons:

- Financial Management: It helps in tracking your expenses more accurately.

- Fraud Detection: Unfamiliar entries could be red flags for unauthorized transactions.

Types of Deluxe Bus Services

Deluxe bus services come in many forms, including:

- Long-Distance Travel: These buses offer enhanced comfort for longer journeys.

- Luxury Commuter Services: Catering to daily commuters seeking extra comfort.

Analysis of Deluxe Bus SYS Transactions

Analyzing such transactions involves checking the date, amount, and context of the service. It’s crucial for budgeting and recognizing your spending patterns.

Steps for Transaction Analysis

- Review Transaction Details: Look for the date, amount, and any additional information provided.

- Match with Personal Records: Cross-check with your records of travel or commuting.

Importance of Regular Monitoring

Regularly monitoring your bank statement for entries like Deluxe Bus SYS is crucial for maintaining a healthy financial life.

Deluxe Bus SYS: Fraud Prevention

The appearance of Deluxe Bus SYS on your bank statement could sometimes indicate fraudulent activity, especially if you don’t recall authorizing such a transaction.

Identifying Fraudulent Transactions

- Unrecognized Transactions: If the entry doesn’t align with your travel history.

- Recurring Unfamiliar Charges: Regular charges that you can’t account for.

Steps to Take in Case of Suspected Fraud

- Contact Your Bank: Report any suspicious activity immediately.

- Review Your Account Regularly: Stay vigilant about your account activities.

Deluxe Bus SYS in Personal Budgeting

Integrating Deluxe Bus SYS transactions into your budgeting helps in better financial planning and management.

Role in Budget Planning

- Expense Categorization: Classify such transactions under travel or commuting expenses.

- Monthly Budget Analysis: Assess how these costs impact your overall budget.

Tips for Efficient Budgeting

- Set Spending Limits: Based on your analysis, set limits for similar future expenses.

- Plan for Future Expenses: Anticipate and plan for upcoming travel costs.

Trends in Deluxe Bus Transportation

The deluxe bus industry has seen various trends that could influence the frequency and nature of Deluxe Bus SYS transactions.

Emerging Trends in the Industry

- Increased Demand for Luxury Commuting: Growing preference for comfortable daily travel.

- Technological Advancements: Online booking systems and in-bus amenities.

Impact on Consumer Spending

These trends can lead to more frequent and varied Deluxe Bus SYS entries on bank statements.

Why Does This Charge Come In The Electronic And Miscellaneous Withdrawals Category?

The “Deluxe Bus SYS” charge is categorized under Electronic and Miscellaneous Withdrawals due to its nature as an electronic transaction. This category typically includes various types of non-recurring, electronic payments or withdrawals.

These could be online purchases, automatic bill payments, or, in this case, charges for services like deluxe bus bookings. Since most of these transactions are processed electronically, they fall under this broad category, which helps banks and customers in organizing and identifying transactions more efficiently.

What Is DLX FOR Business Charge?

DLX FOR Business” charge refers to a transaction made for services offered by Deluxe Corporation, a company known for providing business services, including check printing, promotional products, and marketing services.

This charge typically appears when a business avails of one of these services, with the transaction being processed under the name “DLX FOR Business.” Businesses need to recognize and verify these transactions to ensure they align with their records of services received from Deluxe Corporation or similar service providers.

How To Report Fraud Deluxe Bus SYS Charge?

Reporting a fraudulent “Deluxe Bus SYS” charge involves several steps. Firstly, review your bank statement and confirm the charge is indeed fraudulent. If it is, contact your bank or credit card issuer immediately to report the suspicious transaction.

Provide them with all the necessary details, such as the date of the transaction, the amount, and why you believe it’s fraudulent. The bank will then initiate an investigation, and you may be issued a temporary credit during this period.

It’s also advisable to monitor your account closely for any further unauthorized transactions and consider updating your account credentials for enhanced security.

Conclusion

Understanding entries like Deluxe Bus SYS on your bank statement is not just about identifying a transaction. It’s about gaining insights into your spending habits, ensuring financial security, and making informed budgeting decisions.

By recognizing and analyzing these entries, you safeguard your finances and contribute to a more organized financial future. Remember, staying informed and vigilant is key in today’s digital banking era.

People Also Ask

How Can I Include Deluxe Bus SYS Transactions in My Budget?

Categorize these transactions under your travel or commuting expenses. Track them over time to understand their impact on your budget and adjust your spending accordingly.

Will My Bank Notify Me of a Deluxe Bus SYS Transaction?

Banks usually notify you of transactions based on your alert settings. You can set up transaction alerts to get notified whenever there’s a charge on your account.

Can Deluxe Bus SYS Appear for Online Bus Ticket Bookings?

Yes, this entry can appear for online bookings as well. Any transaction related to deluxe bus services, whether made online or offline, can show up as Deluxe Bus SYS.

How Can I Prevent Unauthorized Deluxe Bus SYS Charges?

Regularly monitor your bank statements, set up alerts for new transactions, and use secure methods for online payments. Always be cautious when sharing your card details.

Matt Rex brings 12 years of specialized automotive expertise, holding a professional degree in Automotive Engineering Technology. As the founder of Turbochaos, he delivers comprehensive diagnostic services, performance optimization, and fleet maintenance solutions, backed by advanced certifications in hybrid/electric systems and ADAS technology. Its innovative methodologies have earned industry recognition while maintaining a 98% customer satisfaction rate.